Irr and npv calculator

You can use special financial calculators likeTi-83Ti-84 and HP 12c calculator or programs like Excel. IRR Future Value Present Value1 Number of Periods 1.

Excel Npv Function Double Entry Bookkeeping Time Value Of Money Excel Business Entrepreneurship

NPV is the value in todays dollars of future net cash flow R by time period t.

. But with IRR you calculate the actual return provided by the. Net present value internal rate of return and payback period and see the results in dynamic graphs. The net present value is the final cash flow that a project will generate potentially ie positive or negative returns.

This is a common way to determine how successful the general. Internal Rate of Return - IRR. If you are looking for how NPV and IRR are derived you will appreciate.

Whereas NPV can show the projects net present value in dollars the IRR reveals the rate of return from NPV cash flows received from a solar investment. Our NPV calculator will output. Measures the return from a funds portfolio.

The definition of net present value NPV also known as net present worth NPW is the net value of an expected income stream at the present moment relative to its prospective value in the future. How to Calculate the IRR on a Texas Instruments Ti-83 Calculator 3 How to Calculate IRR on a Financial Calculator You May Also. Precision Financial Calculator is not just like a numeric calculator you are playing here.

A dollar amount can be very beneficial. Calculates IRR NPV on-line from cash flows input. Step 5 Choose the Methods to Assess a Project Option eg.

Compounding Investments Excel Calculator. Net present value benefit-cost ratio payback period return on investment and internal rate of return are the most common methods to assess economic effects from projects investments and. 2ND unless you want to reset all your settings back to factory settingsFor more info on how to reset your calculator see the Help FAQ section.

The investment can be made up of a series of cash flows. If you accidentally did that or if one of the proctors did that to your calculator before. Why is a NPV calculation useful.

In this case the NPV of project A and project B cant be compared for the decision-making process since the size of the 2 projects is different. Whereas the internal rate of return is the discount rate at which the NPV becomes zero or reaches the break-even point Break-even Point In accounting the break even point is the point or activity level at which the volume of sales or revenue exactly. Mutual Fund Fee Calculator.

The alternative formulas most often taught in academia involve backing out the IRR for the equation to hold true and require using a financial. What is Net Present Value. Initial Investment - The amount of the initial capital investment.

About IRR Calculator. You can use the NVP formula to calculate your internal rate of return IRR or the discount rate that would make the NVP for all cash flows from a project equal to 0. NPV BCR IRR A cost benefit analysis can be performed with different tools and techniques.

We can be confident with an IRR of 2004 but if you are really picky you may work even further to get a more exact IRR in this case you would get something like 2003985. Further users can compare the IRR of different projects and go for the most profitable one. Calculating IRR internal rate of return can sometimes become too complex.

Payback period Meaning Usage Illustrations NPV Net Present Value Formula. Internal rate of return is a discount. Another disadvantage of NPV is that it only looks at the profitability of a single project or investment.

There are two ways to measure IRR. NPV Calculator with IRR Net Present Value Internal Rate of Return. So if your IRR is 12 it means that your solar energy investment is projected to generate a 12 return through the life of the solar system.

Investment Appreciation Rate - The rate at which your initial capital investment may appreciate each year based on your estimates and projections. IRR is the annualized return on an investment expressed as a percentage. Internal Rate of Return IRR is a metric used in capital budgeting to estimate the profitability of potential investments.

Net Present Value - NPV. Rule of 72 Calculator. The management approves an investment or a project if its IRR internal rate of return is higher than the cost of capital or the required rate of return.

To find the IRR set the NVP to 0 and solve for the discount rate or rate of return. Assuming your capital budget is 7 million Project A requires 10 million and produces an NPV of 2 million. With NPV you assume a particular discount rate for your company then calculate the present value of the investment more here on NPV.

Investment finance cash flow capital budgeting npv. NPV IRR Calculator Glossary. The Key Differences Between NPV and IRR.

Equity IRR Waterfall Template for Download. Make sure that you dont execute the RESET function ie. NPV is used in capital.

That is there can be more than one investment or one withdrawal. This means that our IRR or compound rate of return for Machine 2 is 2004. US Health Savings Account Calculator.

Next navigate to the NPV field and input the rate of return. Return On Investment ROI Calculator. The internal rate of return IRR shows the annualized percent return an investors portfolio company or fund has earned or expects to earn.

The users manual provides you a thorough understanding of financial calculations. BA II Plus calculator 3 recommended settings for CFA exams. DataDynamica Precision Financial Calculator.

We can also state that IRR is the rate at which the NPV of the project will be zero. Number of Years - The number of years youll be projecting the NPV IRR analysis into the future. Deal IRR also known as gross IRR.

To calculate NPV start with the net cash flow earnings for a specific time period expressed as a dollar amount. NPV does not take the size of the project into consideration. IRR Calculator Help.

IRR Calculator is one such free online tool to calculate the internal rate of return of an investment. Feasibility Metrics NPV IRR and Payback Period Excel Template. Why use a net present value calculator.

However there has to be at least one or each The cash flows may occur on any date and for any amount. Unlike the IRR or MIRR calculations that express results in percentage terms the NVP calculation reveals its results in dollar terms. Then press the CPT key to determine the NPV on a financial calculator.

Net Present Value NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. Impact on other areas of business. There is a project B that requires 5 million and produces an NPV of 05 million.

Once you have inputted the cash flows press NPV on the calculator to solve. IRR and NPV together can help one understand the profitability of the project and also choose the most suitable project with a positive NPV. The Net Present Value IRR gross return and the net cash flow over the entire period.

For example an NPV of 1000 is great when the initial investment is 2000 but would be negligible if the initial investment was 1000000. Ie Present value of cash inflow Present value of cash outflow zero. Tax Equivalent Yield Calculator.

Conceptually the IRR can also be thought of as the rate of return wherein the NPV of the project or investment equals zero. In general the higher the IRR the more potential a project has for growth.

Financial Calculator Financial Calculator Time Value Of Money Financial

Npv Irr Calculator Template Excel Template Calculate Net Present Value Internal Rate Of Return In 2022 Excel Templates Excel Tutorials Excel

Irr Internal Rate Of Return Definition Example Financial Calculators Balance Transfer Credit Cards Cost Of Capital

Profitability Index Formula Calculator Excel Template Regarding Net Present Value Excel Template Excel Templates Agenda Template Meeting Agenda Template

How To Calculate Npv In Excel 10 Steps With Pictures Wikihow Excel Templates Excel Proposal Templates

Formula For Calculating Net Present Value Npv In Excel Formula Excel Economics A Level

Calculate The Cash Flow Value By Net Present Value Calculator Npv Calculator Is The Calculator By Which You Can Get T Cash Flow Calculator Financial Decisions

How To Calculate Irr In Excel Npv Irr Calculator Excel Template Excel Templates Excel Calculator

Npv Calculator Template Free Npv Irr Calculator Excel For Net Present Value Excel Template Excel Templates Agenda Template Template Free

1 Ba Ii Plus Cash Flows Net Present Value Npv And Irr Calculations Youtube Cash Flow Calculator Financial Decisions

Internal Rate Of Return Spreadsheet Spreadsheet Template Spreadsheet Cash Flow

Using Excel To Calculate Npv And Irr Youtube Financial Analysis Excel Calculator

Calculate Financial Formula Irr And Npv In Excel By Learning Center In Urdu Hindi Youtube Sms Language Learning Centers Excel Tutorials

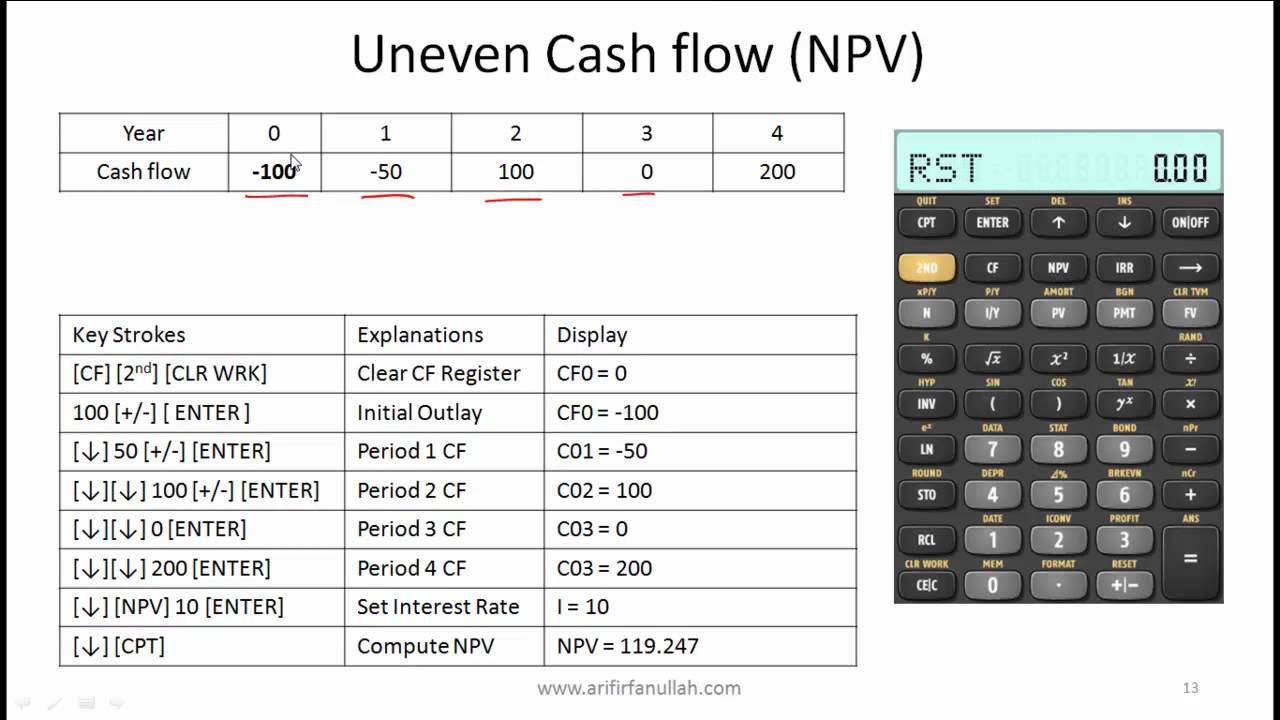

Texas Instruments Ba Ii Plus Tutorial For The Cfa Exam By Mr Arif Irfanullah Youtube Exam Financial Calculator Tutorial

Irr Calculator Internal Rate Of Return With Dates Plus Npv Financial Calculators Dating Calculator

Pin On Wikihow To Manage

How Internal Rate Of Return Irr And Mirr Compare Returns To Costs Investment Analysis Investing Analysis